10 Things You Can Do To Improve Your Bad Credit Score

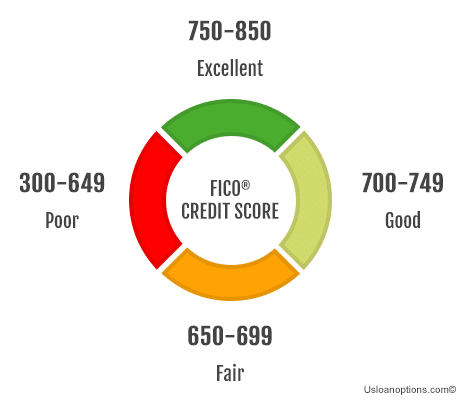

A credit score is an important part of a person’s financial life, providing a numerical indicator of their financial health. It’s calculated using details included in a person’s credit report, such as loan and credit card payment histories, the amount of credit used relative to total available credit, and current outstanding debt levels. Generally speaking, higher scores indicate better overall financial health and potential access to greater opportunities for loans or other forms of financing. A lower score may result in higher interest rates being charged on any future borrowing or even dismissal from certain types of applications.

As such, it is important for individuals to familiarize themselves with their own credit score and know how to improve it when necessary.

Improve your credit score from Bad to Good – Before applying for a loan

Having a good credit score can greatly impact your daily financial endeavors. From suppressing your mortgage fee to acquiring a credit card, simple routine tasks are habitually determined by your personal credit. Where your credit score stands at the moment doesn’t really account for anything; you can always make improvements. Converse to public views, there are numerous things that can be done rather than just waiting for felonious payments to be deleted from the credit report.

The following proactive measures could greatly help you advance your bad credit score within the shortest time possible:

Check Your Credit Report: Knowledge is power so take the time to find out what’s actually on your credit report. There may be old or incorrect information that you don’t even know is hurting your credit score. You can access your three reports for free once a year from AnnualCreditReport.com. If you want to see your actual credit score, you can pay a small fee through the major credit bureaus: Experian, Equifax and TransUnion. You can also get all three FICO scores and corresponding credit reports at once through MyFICO.

Dispute Credit Errors in Writing: If you do see something on your credit report that’s incorrect, you may be able to get it removed by initiating a dispute with the credit bureau. While there are options available to complete the process on the phone or over email, you’re most likely to have success by sending a formal letter via certified mail with a return receipt. This helps you track that your request was received which is important because the bureau must complete the investigation process within 30 days. Having your paperwork on hand to reference can help your odds for a successful dispute.

Timely Bill Payments: This is the simplest method; though it may not overtly improve your credit score, making timely monthly payments plays a crucial role in preventing your score from any decelerations. Therefore, before undertaking any other expenditure, be certain to settle those monthly bills.

Make Substantive Credit Card Payments: Credit agencies evaluate your available credit and compare them to the debts you owe. It’s, therefore, imperative that you try hard to attain 30% or even less. For instance, if your credit card is indicative of $12,000 and what you owe is above $4,000, making additional payments to bring down your debt to 30% will amazingly boost your score.

Consolidate Your Balances: Credit agencies normally observe the number of your credit cards bearing any balances. Concentrate on clearing all the small debts you owe in order to minimize the overall debt. Again, ensure that all your debts are consolidated onto a single card, presuming that it will come with significant interest rates and the debt falls within a 30% range.

However, be sure to keep your zero-balance accounts open to help maintain the age of your overall credit history.

Diversify Your Credit Cards: If you only have one credit card, consider adding two additional accounts but maintaining a zero balance on each one. This helps to increase your available credit. Even if you have a balance on the first card, your overall credit utilization will decrease since your limits are higher. Just make sure you don’t start racking up large balances on your new cards or your credit will suffer even more.

Pay Balances Before They’re Due: Even if you pay down your credit card balance to $0 each month, those charges could still be hurting your credit score. That’s because credit card companies rarely report your balance the same time as your bill’s due date. So if you charge a lot on your card and then pay it off at the end of the month, the credit bureaus may still register a high balance. Find out when your credit card company reports to the bureaus and make that your new due date. You could also make two payments a month to help lower your credit utilization.

Upgrade Your Secured Credit Cards: Using a secured credit card can sometimes be a potential alternative to a bad credit loan, if you have savings set aside to use as collateral. Once you’ve made six months of successful payments, however, ask for an upgrade. Not only will you free up those savings, you could also increase your available credit balance

Piggyback on the credit card of someone with good credit by becoming an authorized user. Just make sure their history is good.

Minimize Loan Inquiries: The credit score becomes dinged whenever you make a new loan application since it designates that you’re requesting for more funds and could be more hazardous. There are two types of credit checks, soft and hard. Soft doesn’t affect your credit score, hard does. Even if you do have hard inquiries on your credit report, you can wait them out pretty easily for a natural boost to your score. They’ll be listed on your report for two years but stop affecting your credit score after just one year. It may be worth waiting to take out a bad credit loan if you have many inquiries about to age out.

If you really want to improve your credit score, these four steps will work out perfectly for you; simply observe them. You’ll be surprised at how your loan accessibility and interest rates get better. Keep it in mind that these measures should be practiced consistently in order to achieve a long-lasting financial impact and help you transition from bad credit loans to less expensive options.

Debt consolidation strategy with bad credit score

One of the best ways is to first improve your credit score, then apply for a new personal loan with better interest rates to save money in the long run.

Taking out a new, larger loan (even with bad credit) and consolidating your older loans into one can often help you get better interest rates, which in turn can raise your credit score by it self. Doing this over time, improving credit score, consolidating loans over and over again, is in our view the best way to pay off debt.

Over time, this may save you money on all types of loans, from mortgages to car payments.

Additionally, even if you can’t get a lower rate right away, taking out a new personal loan could still strengthen your credit as long as you make all of your payments on time and in full. With careful management and responsible repayment, taking out a personal loan could be the perfect solution to improving your credit score.